When the federal Liberal government tabled the 2018 budget, one of the more noteworthy items on the books were the proposed changes to the Working Income Tax Benefit that encourages lower income workers in Canada to stay in the workforce. The most notable change is the renaming of the program from Working Income Tax Benefit to Canada Workers Benefit, with the new benefit being implemented for the 2019 tax year.

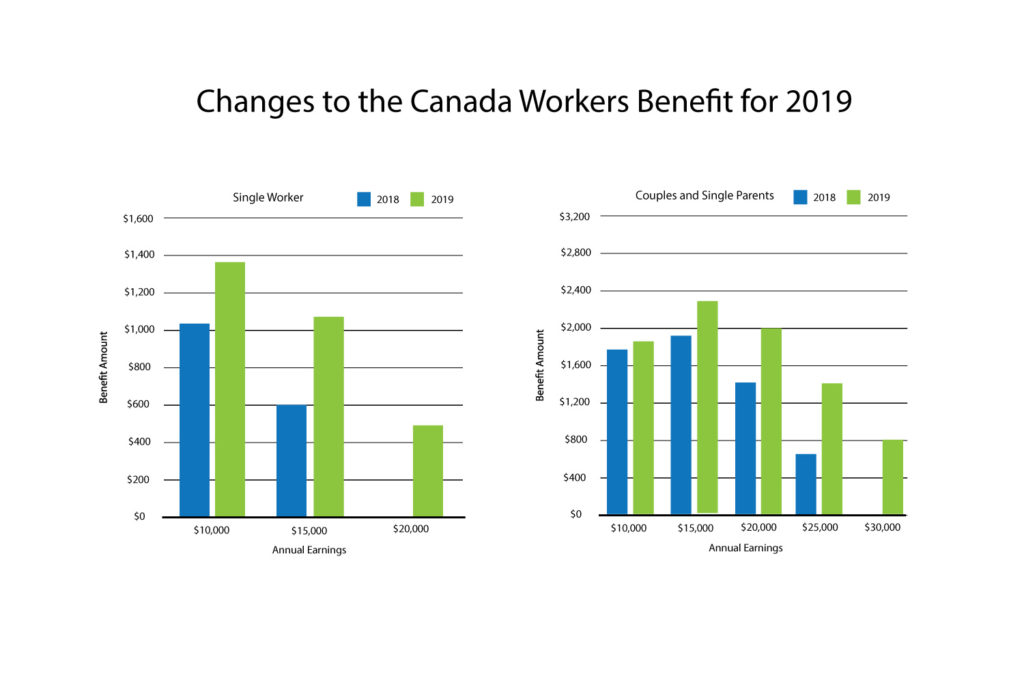

The current Working Income Tax Benefit is calculated at a rate of 25% of earned income over $3,000 with a reduction rate of 15% on income over $12,016 for singles and $16,593 for families, to a maximum benefit of $1,059 for individuals or $1,922 for families. To claim the Working Income Tax Benefit you currently need to complete a Schedule 6 and claim the calculated amount on line 453 of your return.

The new Canada Workers Benefit increases the basic rate to 26% of earned income over $3,000 as well as raising the reduction threshold to $12,820 for singles and $17,025 for families, while lowering the reduction rate from 15% to 12%, for a maximum benefit of up to $1,355 for individuals and $2,335 for a family. The CRA is also making claiming the benefit easier by automatically calculating the claim for anyone eligible to receive it so nobody will miss out on the benefit now.

This new program will come with a considerable price tag attached that the federal government has allocated an additional $500 million dollars per year on top of the current funding for the Working Income Tax Benefit. The goal is to encourage greater participation in the work force, boosting productivity and reducing reliance on other social programs, which should help offset the added costs of the program. So far economists are having mixed feelings about the changes and several have suggested that the increases are not significant enough to have any real impact on the labour market, but only time will tell. For the roughly 2 million Canadians who will see more money in their pockets at the end of the year, it’s a welcome change.